We offer Index CFDs like no one else!

Benefit from some of the best possible trading conditions

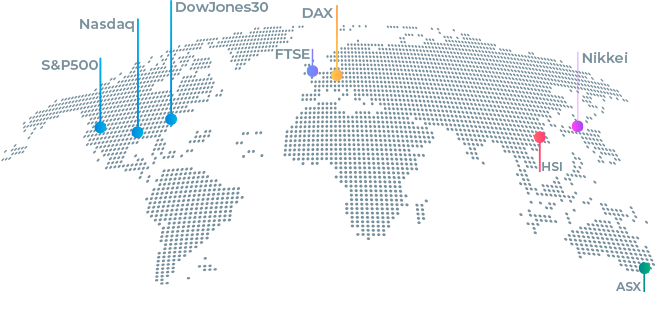

- ✔Trade the major US and EU indices as CFDs as well as regional ones from Australia and the Asia-Pacific

- ✔No commissions

- ✔Experience superior execution & trading conditions

- ✔Spreads from 0.01 on micro US indices

- ✔Mini and micro indices for a fraction of the market price

- ✔EU-regulated company with 25 years of experience

For further information, please refer to our TRADING CONDITIONS.

Regulated by:

Why DeltaStock

Delta Trading

Test your strategies without risk, in real market conditions

Trade indices with Europe's No. 1 CFD provider

An index is a portfolio of company stocks that represents a particular market or industry sector. The major global economies and some of the developing ones have at least one financial index that represents them. Some have more than one.

Indices can be quite volatile and are affected mainly by supply and demand and by major political or economic events related to the country or market they represent. Index trading is quite popular among investors and, according to some sources quoting empirical research, investing in indices tends to outperform active management in the long run.

However, indices can only be traded through derivative instruments that mirror their performance, such as ETFs, index funds, futures or CFDs.